Tags

It would seem, based on many of the things I’ve been reading, that allowing a variety of parallel currency systems to emerge would help meet the needs of people in these rough economic times, provide jobs, and create options for how value is created and exchanged. I don’t imagine it to be a panacea for all our problems (the system’s way too complex for that), but I do find cause for evidence-based optimism. There are some interesting historical precedents of local currency solutions being highly effective, and some scary implications of what happens when you take away this ability for people to help themselves. Allow me to share a bit I’ve been reading in Bernard Lietaer’s book, The Future of Money:

First, he gives a nice description of the socio-political consequences of what he calls “the vicious circle of unemployment.”

(I love reading about feedback loops. So much of our thoughts and behaviors are based on the programming and conditioning of the space between our ears, and you can just look at how we’ve responded in the past to similar situations to get an idea of what’s going to happen in the future.)

6 Step Feedback Loop:

1. Unemployment creates a feeling of economic exclusion

2. Part of those touched express it through violence

3. Most ordinary people react to the violence with fear

4. Community breaks down, society becomes unstable, political polarization increases

5. Fewer investments take place, fewer things are bought

6. The investment climate deteriorates. More unemployment is created.

Repeat.

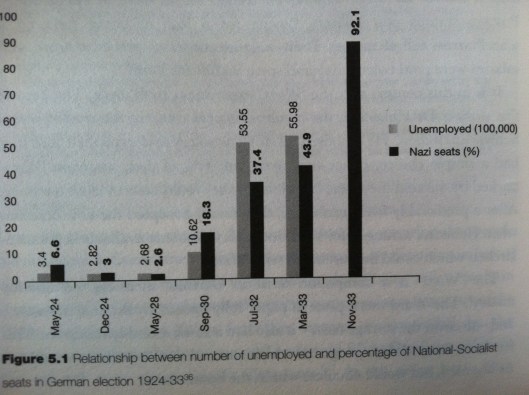

Lietear then gives examples of how we’ve seen this cycle over and over throughout history, and what people do about it. Since there is really no shortage of work to be done, and no shortage of people willing and capable of doing the work, the issue is that there’s just no money to incentivize people to do it. So, how about changing the monetary framework?It’s been shown to work, time and again. Here’s a story about the German ‘Wara’ system:

Lietear then gives examples of how we’ve seen this cycle over and over throughout history, and what people do about it. Since there is really no shortage of work to be done, and no shortage of people willing and capable of doing the work, the issue is that there’s just no money to incentivize people to do it. So, how about changing the monetary framework?It’s been shown to work, time and again. Here’s a story about the German ‘Wara’ system:

As a response to the hyperinflation period in Germany in the 1920s, a monetary experiment took place in the small town of Swanenkirchen. A coal mine owner, faced with the closing of the mine, created a new currency called Wara, which was backed by the coal inventory. A monthly demurrage tax was implemented, which disincentivizes hoarding and keeps money circulating within the community. The coal mine workers agreed to accept 90% of their pay in Wara, and other merchants in town agreed to accept Wara as payment for goods and services.

The currency worked so well that it began spreading until over 2,000 corporations in Germany were using it. The central bank perceived a threat, and in October 1931 the Ministry of Finance decreed the Wara illegal. Consequently, the coal mine shut down, unemployment went up again, and social unrest increased.

The chapter then continues with many examples of alternative currency designs and implementations, like the Worgl stamp scrip, US Depression scrip, the Swiss WIR, mutual credit systems like LETS and Time Dollars, currencies designed to boost regional economic development, others designed for financing small businesses, and yet others as local loyalty schemes.(shameless plug for Contact Conference: this stuff is all alive and well today, though admittedly, still on the fringes of society. at next month’s conference, we have several people coming to represent their projects in this space – Caroline Woolard of OurGoods, a barter network for the creative community in nyc, Guillaume Lebleu of Bernal Bucks, a debit card that earns points redeemable at local merchant shops in the neighborhood of Bernal Heights in San Francisco, Art Brock of The Metacurrency Project, an attempt to create the infrastructure for digital currency interoperability, and Matthew Slater of CommunityForge, a Drupal-based mutual credit platform that runs many of the LETS and TimeBanking communities.)

The chapter then continues with many examples of alternative currency designs and implementations, like the Worgl stamp scrip, US Depression scrip, the Swiss WIR, mutual credit systems like LETS and Time Dollars, currencies designed to boost regional economic development, others designed for financing small businesses, and yet others as local loyalty schemes.(shameless plug for Contact Conference: this stuff is all alive and well today, though admittedly, still on the fringes of society. at next month’s conference, we have several people coming to represent their projects in this space – Caroline Woolard of OurGoods, a barter network for the creative community in nyc, Guillaume Lebleu of Bernal Bucks, a debit card that earns points redeemable at local merchant shops in the neighborhood of Bernal Heights in San Francisco, Art Brock of The Metacurrency Project, an attempt to create the infrastructure for digital currency interoperability, and Matthew Slater of CommunityForge, a Drupal-based mutual credit platform that runs many of the LETS and TimeBanking communities.)

This is all very interesting to me. A few years ago when I heard of the idea of complementary currencies, I thought it was radical. Now, it just seems to make a lot of sense.Why have only one type of currency, designed with its inherent biases, to carry out all the functions of a society? Why not devise different mechanisms optimized for different kinds of flows, behaviors, and outcomes?

This is all very interesting to me. A few years ago when I heard of the idea of complementary currencies, I thought it was radical. Now, it just seems to make a lot of sense.Why have only one type of currency, designed with its inherent biases, to carry out all the functions of a society? Why not devise different mechanisms optimized for different kinds of flows, behaviors, and outcomes?

Our current national monetary system operates on interest-bearing money designed for a growth-based economy. It has a variety of systemic flaws baked into its very DNA, which I will save for another post, but here’s a nice article from the Journal of Financial Transformation that can provide an overview of those. But there’s certainly room for the creation of a balanced, integral economy.

If the current system operates in the realm of financial capital and physical capital, (good for commercial transactions), created by central authority and encouraging a mentality of scarcity and competition, then to balance that out, we can have parallel systems that operate in the realm of social capital and natural capital, (good for community transactions), created by the participants themselves, and encouraging a mentality of cooperation and abundance.

So that kind of addresses some ideas around retooling currencies in time of depression/recession. The other argument to be made in support of parallel currencies is in thinking about the future of jobs and work, fundamentally.

This part is a story about accelerating technological change. Especially in developed nations, our technologies are leading to unemployment that isn’t just a temporary situation, but a permanent restructuring process of how the system operates. Here’s a nice futuristic quote by economist John Maynard Keynes from about 80 years ago:”If the economic problem [the struggle for subsistence] is solved, mankind will be deprived of its traditional purpose… Thus for the first time since his creation man will be faced by his real, his permanent problem…There is no country and no people, I think, who can look forward to the age of leisure and abundance without a dread. It is a fearful problem for the ordinary person, with no special talents to occupy himself, especially if he no longer has roots to the soil or in custom or in the beloved conventions of a traditional society.”

This part is a story about accelerating technological change. Especially in developed nations, our technologies are leading to unemployment that isn’t just a temporary situation, but a permanent restructuring process of how the system operates. Here’s a nice futuristic quote by economist John Maynard Keynes from about 80 years ago:”If the economic problem [the struggle for subsistence] is solved, mankind will be deprived of its traditional purpose… Thus for the first time since his creation man will be faced by his real, his permanent problem…There is no country and no people, I think, who can look forward to the age of leisure and abundance without a dread. It is a fearful problem for the ordinary person, with no special talents to occupy himself, especially if he no longer has roots to the soil or in custom or in the beloved conventions of a traditional society.”

This, I think, is what Douglas Rushkoff was getting at in his controversial opinion piece on CNN.com last week, Are Jobs Obsolete?

And sure, we don’t yet have all our basic needs fulfilled, we don’t have free energy, we don’t have nanotechnology-powered 3D printers. But, it’s getting to the point where there’s enough “stuff.” Some of our biggest problems are in the misallocation of resources and poor coordination. So silos break down, organizations become more distributed and decentralized, information technology continues to gallop forward, sensors are embedded in our environments and reporting data, and supply chains increase in efficiency. As we get better at doing more with less, what are all the extra people going to do? Well, many would rather spend their time doing work that meaningful, creative, and fulfilling anyway, but we don’t have the language and the infrastructures to support it yet. (What would an “innovation currency” look like?)

Then there’s the other aspect of accelerating technological change. Increasingly powerful devices available at decreasing cost, connected to the internet, in billions of people’s hands around the world.

“When we have a multitude of currencies that reflect various quality of life indicators, better metrics, humans can be incentivized towards a richer expression of values and behaviors.” Well, that’s your talk right there. If you have less than 5 minutes, then you need to come up with *exactly* what those indicators or metric are, what they measure and why, and what the mechanics of exchange are that support them. You have to be specific, provocative. Know that the Achilles Heel of your argument is that you are adding practical inefficiency and increased complexity and cognitive load to everybody’s already busy lives, so you have to prove what the payoff is in quality of life terms. And you have to close with what the bankers tend to lose or gain with this proposition. Forgive me for being proscriptive (I generally am not) but your “less than 5 minutes” constraint really stressed me out! 🙂 Good luck and let us know how it went.

All best,

Gong Szeto, Santa Fe

http://about.me/gongszeto

hey gong, thanks for your input.

your comment makes me think of a passage i was reading yesterday in the article published in the journal of financial transformation. it talks about the various systemic dysfunctions of current money. i’m going to paste in these 3 paragraphs:

A second systemically dysfunctional feature is the ability of money to earn interest at a compounding rate for an unlimited time. Fiat money is a social construct that can be created with negligible cost and not be based on the existence of any productive real resource. It becomes an artificial or synthetic asset yet it is given the ability to grow in value with- out limit and without any human input through accruing interest. With- out checks and balances this feature is incompatible with establishing a stable system.

Proudohn (1840), a contemporary of Karl Marx, argued that money should depreciate over time. He argued that is was not surplus value from production that exploited labor but the unearned value obtained by own- ers of money through interest payments. Gesell (1916) was inspired by Proudohn and noted that the value of real assets deteriorates overtime. Gesell proposed that money should have usage cost to make investors neutral to owning real assets or money that at that time was redeemable into gold or silver. The ideas of Gesell inspired many communities to in- troduce various types of cost carrying or demurrage currencies that are considered in the next section.

The creation of money that does not deteriorate in value over time also means that a bias is created against increasing productivity by investing in “the processes by which society expands its power to make nature yield its resources more abundantly” [Moulton (1935)]. All such processes that increase productivity wear out but synthetic interest earning assets do not. So a compelling bias is created for investors to allocate human resources to creating, managing and speculating in synthetic assets and so the growth of the financial system rather than in assets that make so- ciety more productive and sustainable. The result is a process described as “financialization” [Palley (2007)] by which the size of the financial sys- tem increases as a percentage of gross domestic product (GDP).

—

i thought it was very interesting that they say that the current design of money actually discourages the creation of a sustainable planet. basically, why bother investing in finding the key to unlimited free energy – there’s no money in that.

so basically money in itself is *designed* to keep us from building the commons or having solutions that are post-consumption.

if that is the case, and people would say that they care about creating a sustainable world, then my logical conclusion would be that we need to have access to currencies that are designed to enable that.

i liked this quote by charles eisenstein from sacred economics:

“[Money is] the primary agent for the coordination of human activity and the focusing of collective human intention.”

Why bother talking to bankers? Our society is going through metamorphosis. The power structure is changing to the detriment of the bankers. Even if they get the message, their next question will be how to preserve power? They can’t! Soon, after they realize it, they’ll get angry. No one likes to lose!

I am not flattered at all by the attention I get from the bankers or from big corporations. But I jump up and down of joy whenever I caught the attention of my peers who can really change the system.

Perhaps I am missing something… What do you want to achieve Venessa?

i was invited to come and provide some “inspiration” about where things are going. i came last year and presented…. was mostly ignored. (https://emergentbydesign.com/2010/11/04/rant-reflections-from-sibos-what-i-want-from-a-bank/)

this year, there are more compelling examples that yes, indeed, parallel systems exist and are growing (Ven, Bitcoin, etc).

i want to try and convey a simple idea that the economy as we know it is not just in a ‘recession,’ there are some fundamental structural changes underway that the current system is not equipped to handle. the way people make meaning together, exchange bits, and create value is happening in a sphere that the current system doesn’t have a language for.

what happens when more and more economic activity is happening in a non-market context? how do we peg value to things like trustworthiness, connectedness, social currency, creativity?

if anything, trying to convey a complex message in 5 minutes is a useful exercise for me in clarity and brevity. how it’s received by this audience is not even really particularly interesting to me. in my eyes, this is just part of a larger evolutionary process that’s happening, and it requires adaptation.

as gandhi said:

“First they ignore you, then they laugh at you, then they fight you, then you win.”

*shrug*

I know you want to decentralize, but you might imagine the banks to imagine how they might facilitate those transactions? Since, as Gong says above, we’re already overwhelmed by all of the diff places we have to go to find the things we need, maybe the banks develop the comm tech for me – a member of the bank – to put out message like “Hey, I have extra tomatoes” or “Hey, I need someone who knows how to fix my tractor.” Just a thought.

correction: might you ASK the banks to imagine…

Venessa, I’m pleased to see you moving deeper into these critical monetary issues, and speaking to bankers about them. In five minutes you can only make one point. I wonder if you might attempt to unpick the very simple notion that in our present system there is necessarily more debt than money. This is lunacy, a recipe for default and servitude. It encapsulates the design problem and points to a solution way outside what is currently on the table. It is unsustainable and drives growth and consumption. This is not open to dispute or interpretation. Most bankers don’t realise this fact.

@matslats This was the core argument from the white paper delivered to Clindon in 1996 – that money imagined into existence as debt was not only unsustainable, but threatened the existence of real human beings:

http://www.p-ced.com/1/about/background/

Matslats good point. My experience is that people in finance community are taught in business school that debt is the engine of economy. It tends to be outside of acceptable reality for many of them to consider an economy not driven by debt. It boils down to a world-view/paradigm problem. Still, matslats, I will hand it to you that you have a good start at how to reach them: show them that their model has a threshold after which it breaks. Still, many of them will just look for other creative ways to keep people in debt when confronted with the reality that the system is broken (because they believe debt is the engine of economy).

Hi

I don’t understand – someone’s debt is someone else’s asset and money, where you mean a narrow measure such as cash, is never going to equate to the amount of debt in an economy. What are you saying here?

Jimloveuk

3% of money is cash issued debt free by government. The rest is bank credit, which means it is created when people borrow it. therefore 97% of the money is debt which needs to be paid back at interest. Therefore there is more debt than money. In a nutshell.

Debt is the engine perhaps not of the economy, but of economic growth. To pay off our debts, we have to convert more and more stuff into bank loans.

I’d suggest focusing on the assumptions, mental models and framing that allowed you to begin this inquiry and look at things a new way. Don’t expect them to jump to where you are now, just lay out the first step through a reframe or a powerful question.

Insufficient it how my colleague described it, going on to associate the increasing numbers of disenfranchised with the potential for uprisings and suggesting the web for an alternate approach placing people first

http://forestofdean.socialgo.com/magazine/read/i-didnt-predict-a-riot-but_52.html

He died last month, true to the ideals he took a lot further:

http://tinyurl.com/3ehs5mq

disruptive innovation is coming, is already here… they have two choices – to try to hold back the flood, or to ride it… and the first choice will definitely lead to failure. the second choice has better odds – even though it feels far more scary, because it is unknown. your mission, (should you choose to accept it 🙂 – is to help them feel less scared of the dark… illuminate the pathway towards radical change..

Venessa,

It’s a fine overview … though I think a few dots are missing to complete the picture. Chris Cook has some wonderful insights on emergence of “unitised” energy-backed and land-backed currencies in his Money 3.0 slides ( http://j.mp/mRr7uw and http://is.gd/debtswap ). Devin Balkind’s CommonNotes.org “acre-month” subscriptions to farm production also have interesting potentials in the future of money.

Personal currencies building on Douglas Rushkoff’s insights in the “Radical Abundance” keynote may also allow communities to fund education (http://is.gd/altfunding), support struggling nonprofits (http://is.gd/help4nonprofits), and foster multipoint P2P exchange via mobile phones (http://is.gd/persnlcurrency ).

It’s possible we’ll also see personally-issued currencies federate in mutual guarantee networks. This could happen through adoption of “flex conversion” notes similar to Josiah Warren’s system in the 1800s http://en.wikipedia.org/wiki/File:LaborNote.JPG . You could issue EBDNotes, for example, denominated in hours of your research time – but with a flex conversion option to be converted into a portion of your square foot garden’s tomato harvest. If tomato blight knocked out your crop, an EBD tribe (or neighborhood) mutual guarantee network might go live to ensure successful delivery for the recipient of your EBDNotes.

I essentially agree with a DIY Economy scenario that automation (3D printing and nanotechnology) and localized algal/bacterial/photosynthesis energy breakthroughs will radically drive down the cost of things. This will make obsolete most traditional kinds of production or intermediating jobs/career paths, but create new opportunities for individuals and places that can offer valued learning or life experiences.

Areas that combine extraordinary low (or free) costs of goods with high quality of life experiences will be in immense demand. Accordingly, the value of their time-backed or land-backed currencies – whether issued by individuals in the form of service offers or lodging/lease flex conversion options, or by communities offering association membership and access (per Ostrom) to their abundance Commons – will soar.

This could be converted into opportunities for existing banks and municipalities that have a lot of foreclosed properties weighing on their balance sheets. To the degree that they open the doors for currency innovation on a demonstration basis, encourage neighborhood self-provision of services (e.g. through deed-based agreements), and remove barriers to the emergence of new learning and exchange systems at these sites for “Radical Abundance”, they may find their properties becoming locations of choice in the next economy.

Best,

Mark Frazier

http://MiiU.org/wiki/openworld

Mark, I’ve been engaing with Chris Cook regularly over the last few years and as you’ll see im my link below, it’s his Open Capital funding approach I intend to use for a local biomass project.

It was interesting to hear/see Douglas Rushkoff interviewed by WSJ. he’s making a lot of the same points about post capitalist economies which were made in Terry Hallman’s 1996 paper on People-Centered Economic Development.

This introduction for the consumption of my local community explains the shift toward a localised and sharing economy, once we get past the obsession with production and profit maximisation.

http://forestofdean.socialgo.com/magazine/read/the-case-for-local-sustainable-enterprise_38.html

Bankers should not be proxy enforcement agents for the jurisdictional authorities’ know-your-customer rules. This violates a fundamental human right to financial privacy. Just ask the 1930s Jews.

I like to frame it like this:

The money we use is Government money or levered Government money (bank credit). Government money is backed by legitimate force. The question is: what do this money become when force becomes not only illegitimate, but ineffective?

I think that we may have or be closed to have reached the limit in using legitimate force (Government) to back our money.

There are several reasons for this evolution: dwindling returns on the use of force in driving the success of large organizations, gridlocked political processes, environmental limits, difficulty to monetize the growing immaterial economy, and many more.

If so, the current monetary system used is likely to continue to deflate, as debts are paid or defaulted on, with regular bursts of inflation by fiscal/monetary authorities but with decreasing marginal returns.

The good news is: we are bound to continue to grow, to pursue Happiness, and we will need systems to continue our growth. But more likely around “soft power” systems, where reputation plays an increasing role.

In other words, the future of money is less money and more not so random of kindness. In other words, we can deflate in monetary terms, but inflate in terms of social currency.

There is a lot for bankers to do here. Banks are not going to go away. As trusted intermediaries, they will likely play an increasing role in providing us with convenient, actionable and reliable access to data about other people and organizations, not just the money we owe or are owed.

This evolution will take time. Money is here to stay, but over time, it may decrease in relative importance to social currency. It’s time for banks – big and small – to leverage their assets and position themselves in this space.

Your post seems to miss the fundamental point of money- An easy medium of exchange. A way to store, archive, and preserve the “memory” of value. That is the primary purpose of money. If social currency can be used to purchase goods or services then it is simply that- money. Value stored in a different way- but money all the same. Now, there is fiat currency (money by decree) and that must always come from a governmental body- if the declaration is to have force. The interesting point of social currency is transferability- ubiquitous acceptability- how does that happen without the “marketing” power of big government? From where does the “fiat” derive? Perhaps, that is a place where banks could put their weight….

To clarify- I was referring to the comment above from @giyom

Daniel, as you know, most of the money we use is already bank-issued checking money in the unit of account of fiat money. Deposits are IOUs of the bank, regulated by the Govt. The demand for most of the checking money we use is not driven by fiat but by the fact that some people want to get in debt and then have to find the money to pay it back. So banks have already put their weight here.

What I am saying in my original comment is that there is a shift in people’s willingness to borrow on the basis of secured IOUs, that is secured by the use of legitimate force to liquidate their assets should they not be able/willing to pay back. Most checking money in the US are backed by mortgages (60% I think), which means that ultimately most dollars are backed by the right of a Sheriff to come to your house, throw your stuff on the street, change the locks and tell you “sorry just doing my job”, then auction off your house.

Having such potential violence backing our everyday’s transactions is not a necessity, and one could argue that it may be counter productive.

Now, people may not be willing to borrow and pay with checking money backed by legitimate violence, but they may still be willing to pay with unsecured IOUs backed by their own productive/creative capacity. So if I’m a programmer, I’m willing to pay with $ backed by my programming skills. Of course, these will not have the same liquidity as $ backed by secured IOUs, but may go a long way in some cases (see [1]). In this model, Banks could play the role of IOU routers in the network of participants, not issuing IOUs of their own and discounting people’s, but merely helping the IOUs flow.

At the extreme, why even give unsecured IOUs, why not just publish for everyone to see that you receive goods/services of a certain $ value on the Web, without any explicit contract to reciprocate, only a social pressure to. Over time, those who reciprocate would certainly receive more goods/services than those who don’t. In this model, banks could play the role of trusted repository of reputation data about participants, making sure your reputation is correctly accounted for and not tarnished/spammed.

In conclusion credit money is just reputation turned into commodity through the use of legitimate force. There is a limit to it though and just as we have experienced a resurgence in commodities as store of value, we may see a resurgence of peer credit as medium of exchange.

IMO, none of this will replace fiat money or bank money, but we will expand the spectrum of possibilities beyond what is currently available.

[1] Liquidity in Credit Networks: A Little Trust Goes a Long Way http://arxiv.org/abs/1007.0515

Very interesting comments. I think what is at the heart of this question is opacity vs. transparency. Banks should have at the heart of what they do an understanding of credit risk. Sounds like an obvious comment, but what the last three years have shown is that for myriad reasons banks lost their focus on this basic basic banking task. Governments aided banks in losing their way, and credit agencies steeped in the moral hazard created by a massive conflict of interest, wrapped governments, banks, and finally the citizens (and taxpayers of the world) in a veil of opaque falsehood. The net result was- very simply that credit risk was not well understood- and risk went unobserved at cataclysmic scale. If we get back to basics banks should use ALL information available- to help evaluate risk. In today’s world that must include social data. I also think (although hugely out of character and perhaps not even legal in today’s financial regulatory environment for bank’s to do so) that bank’s can use social pressure and social encouragement to encourage good behaviour. Behaviour that benefits individuals, communities, and yes, even banks. For banks to play these roles however they have a of trust to rebuild and repair.

Venessa –

Interesting article. On a related note, you might want to read The Overworked American: The Unexpected Decline of Leisure, by Juliet Schor. She talks about the negative consequences of the Productivity Dividend.

As I wrote a detailed comment about this issue on one of Seb Paquet’s G+ post yesterday, I won’t repeat it here. If you’re interested, you can find my G+ comment here:

https://plus.google.com/100313086520534185887/posts/cCuEN9rkA6E

Whatever you tell the bankers, Venessa, (and I am sure you and your collaboratuy group are aware) those that prepare may google you and may be open or uncertain about your future views. Those that don’t prepare may feel your message of a likely future may “break their rice bowl”, to use an Asian metaphor. It refers to competitive battle to the very end, threatening survival, and in Asia you are not supposed to do that.

I believe there are a lot of rice bowls left for the bankers in return of useful services to society, yet the parasitic feeding as if at the swine trough must cease.

Earlier, I proposed

More…

Meant to type “collaboratory group”, posted too early, sorry.

My choice 1 today would not be central bank money but

treasury money that we know (soon again) to trade with people that we do not know .

One less rice bowl/feeding trough. On the consequences of removing interest we may speculate. I think that issue is of such social interest that it should be put to popular vote. Depending on the wish of we, the people, other ways of making profits in finance may have to be found.

from http://www.energybulletin.net/stories/2011-09-15/adam-smith-got-it-way-way-wrong

“We are thus entering a period of prolonged economic contraction—not a recession, or even a depression, but a change in the fundamental dynamic of the economy. Over the centuries just past, a rising tide of economic growth was interrupted by occasional periods of contraction; over the centuries ahead, the long decline of the industrial economy will doubtless be interrupted by occasional periods of relative prosperity. Just as a rising tide lifts all boats, a falling tide lowers them all, and if the tide goes out far enough, a great many boats will end up high and dry. The result is that money can no longer be counted on to make money, and as this becomes apparent, the basis for most of today’s rentier class will go out of existence.”

To clarify my above comment, banks are part of the privileged banking cartel which is led by the central bank(s). This is no different than an oil cartel or a pineapple cartel. After speaking with bankers for over twenty years, I would not have much hope for the presentation slot at SIBOS, but it could be utilized productively to bring publicity to certain issues.

Foremost among those issues would be monetary freedom in the choice of currency and you are well on your way in providing examples. Larry White’s testimony at Ron Paul’s hearing from last week would be another example. See The Free Competition in Currency Act of 2011 at http://www.freebanking.org/2011/09/13/the-free-competition-in-currency-act-of-2011/

Another critical issue for mass awareness is the disturbing trend among governments to employ bankers and financial institutions as proxy agents in their enforcement wars against individuals that have nothing to do with money, banking and payments. The root of this involvement is the know-your-customer rules practiced at cartel-based financial institutions and it is what allows money to be used as a way to track identity and stifle politically-incorrect behavior. This is a fundamental violation of the right to financial privacy. An individual’s transaction with a financial institution should be no different than an individual’s transaction at the store when paying for toothpaste. Transactional privacy and user-defined anonymity are critical elements of a free society.

The image that you chose at the top of your essay is an excellent example of why so many things have gone wrong at so many levels. The depicted 500-euro note is practically an endangered species because several countries have refused to accept them and they will soon be phased out of existence because they do not permit ‘adequate’ identity tracking by the financial authorities. In the US, the 500-euro note would be a $700-bill and the US government is not even sure if they want to continue with the $100-bill. Sadly, a non-anonymous cashless society will NOT be a fun place to live for people deemed to be politically incorrect!

Briefly re “Money”:

Along with most here I’m convinced there are big problems in banking, finance and the creation and allocation of ‘credit’… especially via centralized entities with narrow interests…

“Money” is not only the currency but also the pathways by which it moves… just as a river is both the water that flows through it and the banks that bound its path.

So we have the medium of exchange itself and how it comes into being whether coins, cash, scrip or simply entries in a ledger.

And the methods by which it is ‘moved’… whether via technologies like checks, wire transfers, Facebook Credits or swiping a card through some device.

BOTH aspects are problematic for many reasons. ONE (but only one) of those problems is that…

BOTH the water and its banks in the world’s ‘river of money’ are controlled by narrowly focused interests.

There are many efforts to facilitate new mechanisms for currency and credit creation. That’s a good thing. But neither the current credit creators nor the transaction networks they own are going to be very helpful in those attempts.

SO…. I’ve chosen to address the other piece… the transaction network. I believe its only by catalyzing such a neutral, commonly-owned transaction ‘utility’ that these alternatives may have a chance to grow.

Re-Igniting the Enlightenment: On Building Landscapes for Decision

http://culturalengineer.blogspot.com/2010/12/re-igniting-enlightenment-on-building.html

P.S. RE “What to talk to the bankers about”…. very tough in 5 minutes…. but my Bangalore friend, Hariharan P.V. ( http://zerowastezerocarbon.wordpress.com/contact-us/ ) has a good question: Thousands of farmers in India have committed suicide. They are trapped by a banking ‘philosophy’ that only will lend for cash crops like cotton….(gotta push that International Trade after-all) rather than for food crops geared to local sale and use. Moreover they must buy Monsanto non-germinating seeds that force them to buy new seed every year rather than being able to save seed. Ask the bankers how new technologies making it easier to pay with your IPad or the use of Facebook Credits with enormous transaction charges can address those issues.

Congratulations Venessa once again for all your work in trying to create and share new ideas for this new world and paradigm we are all moving towards.

I am sure you will do very well at Sibos this year and hoe that many bankers start to understand their obsolete model…

The question is: can new ideas and concepts win the battle against the old strong lobbies?

All the best

Multiple currencies are a huge threat to the establishment. How does the Fed tax income on an alternate currency? What works isn’t what our governments want. They want to maintain their power and control. I’m surprised virtual currencies have gotten as far as they have without being prohibited, but they aren’t seen as a threat yet, because none of them are mainstream with the yokels.

“Now how to describe this to the bankers in under five minutes…”

To hell with the bankers, they’re the ones collecting the interest on the present currency systems. There’s no reason GETS and LETS and Time Banking and other trade systems couldn’t and shouldn’t bypass banks completely. As you noted, banks will probably do everything in their power to stop them. The less they know, the better.

there is a reason not to bypass them, and your second to last sentence is it. better to boil the frog slowly. security through obscurity is not a long term strategy. the banks and the government will eventually notice they are being disintermediated and their reaction will be strongly negative, it is best to bring them in wherever possible, while not allowing them to dictate the terms of their engagement.

I think this is also the reason Vanessa’s talk is important, communicate early and often to avoid shock reactions. The bankers should be bored of the ideas by the time they start to affect them.

hi kurt, how ist it going? finally i` ve found you in the deep depths of the internet. remember me? i was the german exchange student living next door to you in elmslay hall, saint mike at th uoft. the weird place. we had lots of fun in 91 and 92 and talked your girlfriend over and over again.

if you care give me a sign at chrissnrw@gmx.de

jesus and bye!

chris

re: work: I wonder sometimes why an “intelligent society” strives for 0% unemployment. Should it not strive for 100% unemployment and free it´s members of tasks they not wish to pursue?

Thanks for doing this write up Vanessa. One thought for the bankers is that as wolves, they don’t need to be directly concerned with consuming sunlight, but it does matter to their sustenance.

Here are some thoughts I’m working on with folks in the Time For the World project about currency complementarity – how it increases the activation of dimensions of value beyond what any one currency is optimized to account for. We’re using food webs as an analogous set of hierarchies to currencies.

Trophic currencies: ecosystem modeling and resilient economies (draft)

Marc Brakken, Preston Austin, Stephanie Rearick, Leander Bindewald

https://docs.google.com/document/d/1qvGFN6jHugRszW8V4X4kKJ1Co_LypwcXbCx6MMmtZ-c/edit?hl=en_US

Pingback: Why the Future of Money Matters (Is the current system obsolete?) « There you go again…

This just in via @LotharLochmaier:

Quoting part of a chapter that tells me banking as we know it is an endangered species facing extinction:

2.2. The business model „bank“– a systemic risk

The rescue of banks with tax money in the financial crisis was justified with the argument of “system relevance”. According to this the insolvency of banks up to a certain size and high inter- connectedness endanger the entire finance system’s stability and must to that extent be res- cued by the state. The finance system’s stability is a difficult to define term: primarily the danger of a domino effect is seen here, in the sense, that the collapse of a big bank endangers the liquidity of further banks in the finance system. With pending insolvency of one or more banks the economy’s credit supply is threatened. Meanwhile a “bank run” threatens to occur, meaning that savers fear for the security of their deposits and withdraw them from the bank on short notice.

The problem is that the knowledge about system relevance and public rescue in an emergency stimulates banks or bank management to take even greater risks as to receive greater returns. In case of a success, the bank generates higher profits and the management receives greater bonus payments. In the case of failure and the bank’s pending insolvency, the state covers the losses. Profits are privatized while losses are socialized. The best example for such a “moral hazard behavior” by banks is the current crisis within the Euro zone. The status of a bank, due to its size and interconnectedness, to be considered as “system relevant”, is rather attractive. This reduces the bank’s credit risk substantially. Hence refinancing costs for raising capital are reduced, stock prices go up, and the unspoken-of public guarantee facilitates the acquisition of new wealthy customers with huge savings deposits (Demirgüç-Kunt & Huizinga, 2010)

Your turn.

More from above paper (pdf) at http://bit.ly/nUtyb0

Get rid of banks and build up a modern financial world!

Paper for the 17th Workshop on Alternative Economic Policy in Europe in Vienna/Austria 16-18 September 2011

Rainer Lenz University of Applied Sciences Bielefeld/Germany

Content

1. Introduction

2. Insights from the financial crisis

2 1. Herd behavior versus market efficiency

2 2. The business model „bank“– a systemic risk

2.3. The corporate governance „bank“ failed

2.4. Banking supervision and control

2.5. Mark-to-Market valuation – procyclic accounting

2.6. Rating – no independent and neutral assessment

2.7. Credit derivatives and other derivatives – „perverse world“

3. Status quo of financial market reforms in Europe

3.1. European finance supervision – new institutional structures

3.2. Reforms of the banking system

3.3. Regulation of the OTC derivative market

3.4. Regulation of rating agencies

3.5. Regulation of the shadow banking system

4. Technocracy versus regulatory policy

5. Modern finance architecture without banks

Quoting from the conclusion:

In a place of legal certainty, the P2P-market will in the future guarantee the economy’s credit supply. A multitude of multinational enterprises will operate transaction platforms for capital transferal. Predestined for this, are corporations with Internet sales departments and a large client base, such as Amazon or Ebay. The market could also be of interest for providers of com- munication technologies like IBM or Apple and telecommunication corporations like Deutsche Telekom AG or AT&T. In the corresponding legal realm and under sufficient supervision, capital transfer would be possible through social networks like Facebook or Linkedin. With respect to the financial knowledge and the extent of the customer base, banks could also operate the transferal platform, as long as a strict institutional separation from conventional banking busi- ness is provided.

The finance market of the future consists of a network of regional commercial banks that pro- cess payment transactions and grant loans to regional customers. Parallel to this, there are a multitude of web-based transaction platforms for the transferal of capital. This global world of finance will, however, function without banks, because for the mere transferal of capital no lo- cal “players” are needed.

Retail gift cards are validly viewed as an alternative currency, a medium of informal exchange. In most cases they decline in value; the retailers’ demurrage is quite a profit center.

Do you know there is a film planned to be made about the Worgl? Hollis Doherty was a co-panelist on a panel on Complimentary Currencies in Los Angeles last month.

http://www.heathervescent.com/heathervescent/2011/08/speaking-at-mindshare-project-butterfly.html

Every small business owner should be familiar with and using barter to augment their cash business and increase their bottom line.

But what is wrong with this? I need loans to develop my business. What exactly is your point? Should we dispense with loans? Really not sure where you are going with this.

The debt (which equals the money supply) HAS to keep growing, and growing exponentially. It drives economic growth, and with it consumption of resources. The 99% become ever more indebted to the 1%. That is how we got in this mess of unpayable debts. The only way to pay off the interest on the old debts is borrow more money than before. We end up working harder and harder for the banks who create the money, until the interest burden is so great we default. Then the banks buy everything for pennies on the dollar. Not just our property, our infrastructure, our national monuments, our politicians, if they weren’t bought already, our human rights. It follows as night follows day. Read up on the early 1930s, the script is similar except the stock market hasn’t crashed yet.

The effects of debt and interest explained in some detail in this movie Money as Debt by Paul Grignon.

Pingback: Innovation Excellence | POV: Venessa Miemis on Why the Future of Money Matters

Quietly, a different kind of progressive change is emerging, one that involves a trans- formation in institutional structures and power, a process one could call “evolutionary reconstruction.” At the height of the financial crisis in early 2009, some kind of national- ization of the banks seemed possible. “The public hates bankers right now,” the Brookings Institution’s Douglas Elliot observed. “Truthfully, you would find consid- erable support for hanging a number of bankers…” It was a moment, Barack Obama told banking CEOs, when his administration was “the only thing between you and the pitchforks.” But the president opted for a soft bailout engineered by Treasury Secretary Timothy Geithner and White House economic adviser Lawrence Summers. Whereas Franklin Roosevelt attacked the “economic royalists” and built and mobilized his political base, Obama entered office with an already organized base and largely ignored it.

When the next financial crisis occurs, and it will, a different political opportunity may be possible.

Straight to the source.

Pingback: Why the Future of Money Matters (Is the current system obsolete?) « trackingthefuture

Pingback: 2011 Year in Review & 2012 Intentions & Aspirations « emergent by design

Pingback: The Future of Money: On Markets and Marketing | What Would The Internet Do?

Great beat ! I wish to apprentice while you amend your

website, how can i subscribe for a blog website?

The account aided me a acceptable deal. I had been a little bit acquainted of

this your broadcast offered bright clear concept